Aktuelle Diskussionen

Aktuelle Diskussionen

Vom Community-Manager angeheftet

Vom Community-Manager angeheftetSeller_hwwu0taY2D6Xs

∙Seller_SC9FmRM7t3wMe

∙Seller_Ea1uMSC5Yjs34

∙Seller_JGR17P6kCTQiW

∙Seller_yI3dcEIYCtClF

∙Seller_gTS4TaytmNuTM

∙Seller_KaiSHTSD31Hhx

∙Seller_UL3b71kqY4LDK

∙Seller_JXFzxZNr0I2i6

∙Seller_lrGPflDddzENC

∙Seller_nC2Rw67XBUT1O

∙Aktuelle Diskussionen

Aktuelle Diskussionen

Vom Community-Manager angeheftet

Vom Community-Manager angeheftetSeller_hwwu0taY2D6Xs

∙Seller_SC9FmRM7t3wMe

∙Seller_Ea1uMSC5Yjs34

∙Seller_JGR17P6kCTQiW

∙Seller_yI3dcEIYCtClF

∙Seller_gTS4TaytmNuTM

∙Seller_KaiSHTSD31Hhx

∙Seller_UL3b71kqY4LDK

∙Seller_JXFzxZNr0I2i6

∙Seller_lrGPflDddzENC

∙Seller_nC2Rw67XBUT1O

∙Willkommen bei den Verkäuferforen!

Aktuelle Diskussionen

Vom Community-Manager angeheftet

Vom Community-Manager angeheftetLeitfaden für Kundenanfragen zu Rechnungskorrekturen

von Seller_hwwu0taY2D6Xs

Letzte Aktivität

Zählt DHL Kleinpakt bis Kg zu den Paketen?

von Seller_SC9FmRM7t3wMe

Letzte Aktivität

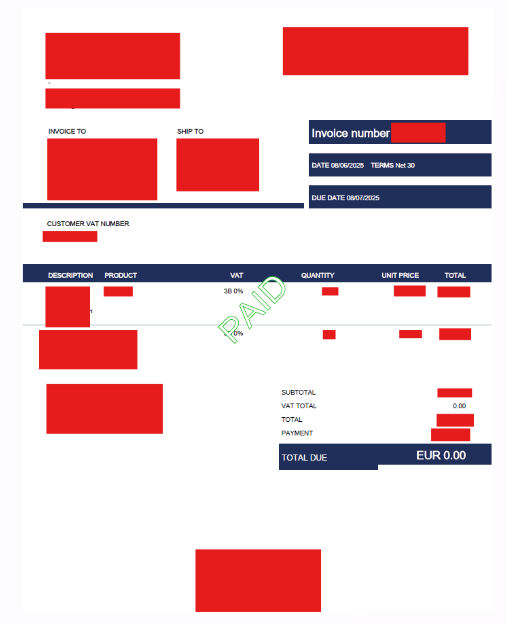

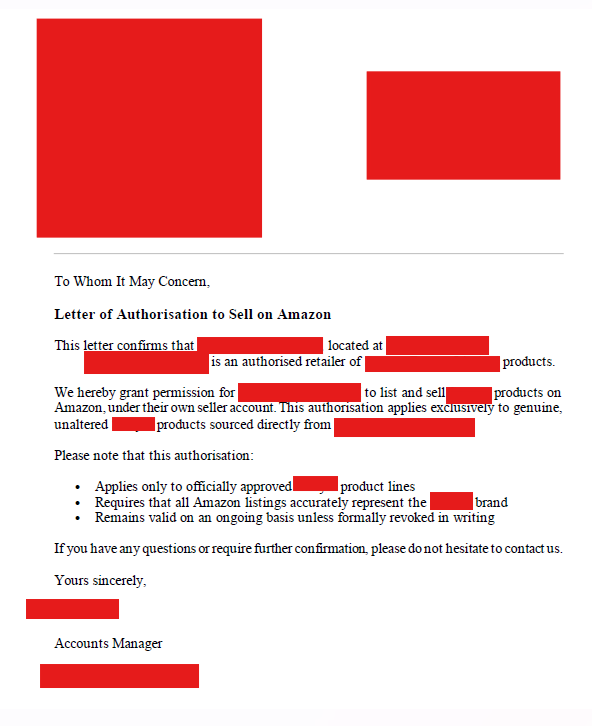

Verkaufsgenehmigung trotz Rechnung & LOA vom Hersteller wiederholt abgelehnt – was tun?

von Seller_Ea1uMSC5Yjs34

Letzte Aktivität

Rate gültiger Sendungsverfolgungsnummern

von Seller_JGR17P6kCTQiW

Letzte Aktivität

Kunde darf Ware behalten wenn diese zu spät ankommt???

von Seller_yI3dcEIYCtClF

Letzte Aktivität

Bewertung entfernen doch so einfach ?

von Seller_gTS4TaytmNuTM

Letzte Aktivität

So gut wie jeder A-Z wird zu Gunsten des Käufers entschieden!

von Seller_KaiSHTSD31Hhx

Letzte Aktivität

FBA Shipping Chargeback seit 3 Tagen 10% vom Umsatz

von Seller_UL3b71kqY4LDK

Letzte Aktivität

Amazon bucht sein 5 Jahren Gebühren ab

von Seller_JXFzxZNr0I2i6

Letzte Aktivität

Gilt A+ Premium für alle Marken im Konto oder nur für eine?

von Seller_lrGPflDddzENC

Letzte Aktivität

FBA = Not Eligible for Buy Box?URGENT! Is This a Bug or a Hidden Rule?

von Seller_nC2Rw67XBUT1O

Letzte Aktivität

Häufig gestellte Fragen

Erfahren Sie mehr über Verkäuferforen, die Teilnahme an Diskussionen und mehr!

Häufig gestellte Fragen anzeigen

Community-Richtlinien

Tipps zur Erhaltung einer sicheren und integrativen Umgebung

Community-Richtlinien anzeigen

Versionshinweise

Bleiben Sie bezüglich der anstehenden Verbesserungen für die Verkäuferforen auf dem Laufenden.

Versionshinweise anzeigen

Nutzungsbedingungen

Lesen Sie die allgemeinen Geschäftsbedingungen für die Verkäuferforen.

Nutzungsbedingungen anzeigen

Datenschutzhinweis

Lesen Sie den Datenschutzhinweis für die Verkäuferforen

Datenschutzhinweis anzeigen

Missbrauch melden

Dieses Formular verwenden, um Missbrauch von Amazon-Richtlinien zu melden

Bericht