Amazon can not provide proof of VAT payment made on my behalf

Hi,

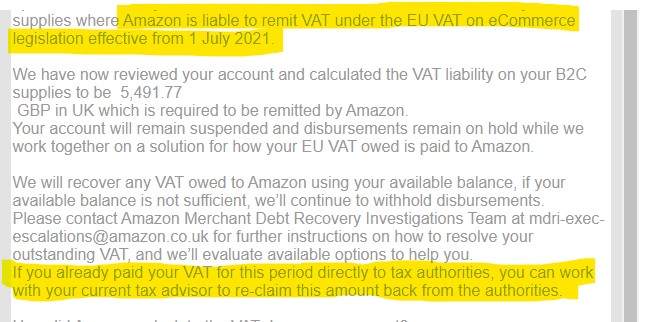

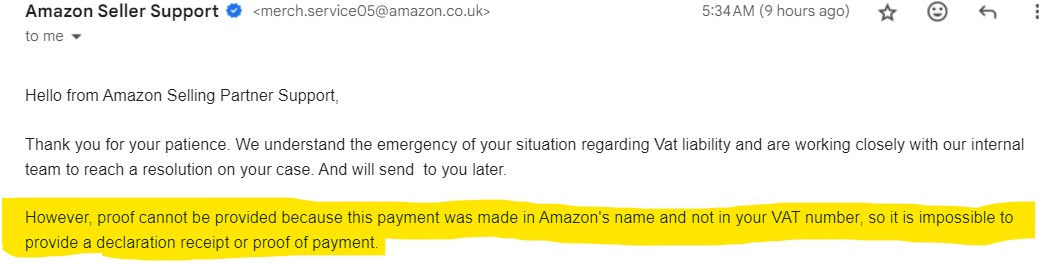

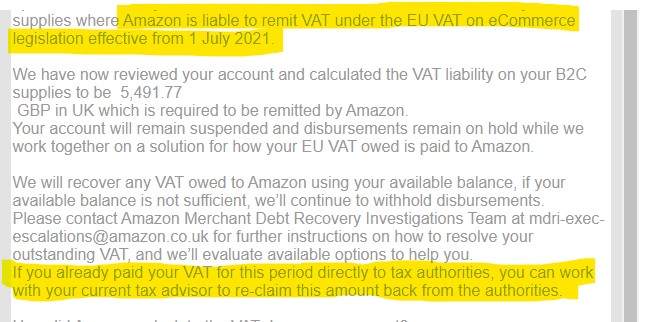

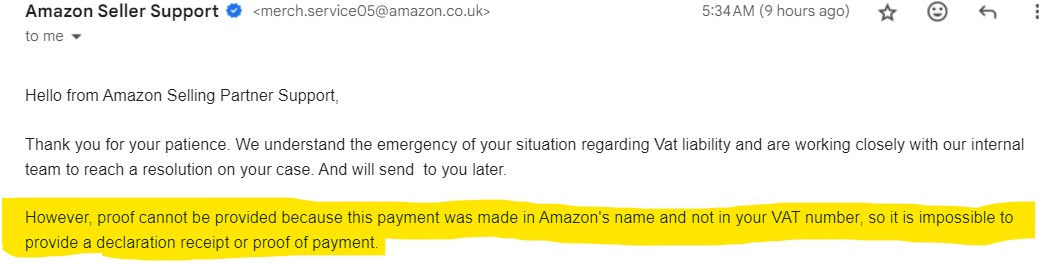

I paid my VAT on time, one day I received a notification that "effective from July 1, 2021 Amazon is liable to remit VAT for Non-UK business establishment, so my funds will be withheld while we pay your EU VAT owed to HMRC...If you already paid your VAT for this period directly to tax authorities, you can work with your current tax advisor to re-claim this amount back from the authorities." so my tax adviser contact HMRC to reclaim the duplicate VAT payment and they are asking to provide proof of VAT payment made by Amazo on my behalf, so I ask Amazon for some proof and this is what they answer "However, proof cannot be provided because this payment was made in Amazon's name and not in your VAT number, so it is impossible to provide a declaration receipt or proof of payment."

Any advise?

RE:[CASE 9634899592]

Amazon can not provide proof of VAT payment made on my behalf

Hi,

I paid my VAT on time, one day I received a notification that "effective from July 1, 2021 Amazon is liable to remit VAT for Non-UK business establishment, so my funds will be withheld while we pay your EU VAT owed to HMRC...If you already paid your VAT for this period directly to tax authorities, you can work with your current tax advisor to re-claim this amount back from the authorities." so my tax adviser contact HMRC to reclaim the duplicate VAT payment and they are asking to provide proof of VAT payment made by Amazo on my behalf, so I ask Amazon for some proof and this is what they answer "However, proof cannot be provided because this payment was made in Amazon's name and not in your VAT number, so it is impossible to provide a declaration receipt or proof of payment."

Any advise?

RE:[CASE 9634899592]

8 Antworten

Seller_RlZVPg3d6ZUGP

Has it definitely come from your account?

Thats crazy that no proof can be provided

Seller_POaq5iFEI55R9

I have been fighting with this issue since September. However, a bit of good news is that since your claim to get money back from the HMRC is under £10k, you can just put it into your quarterly VAT return and it will hopefully slide through. If it doesn't, then you may get asked for proof (or the quarter return will be passed to the Compliance Team who will go through every line in the return). However, they are fully aware of this mess, and the lack of a report from Amazon that shows how they reached the figure they took. It should be OK at that point (if you get pulled into the Compliance Dept) to show them the original notification, the "Expenses" screenshot, and the wire you sent them (if relevant; some sellers sent money in, some used existing balance).

My own issue is that they told me one figure and took £63 more - - - so my two pieces of evidence don't really support each other.....

Seller_tRuvBEHDedp4q

TBH - I am very confused

Are we talking about the EU VAT on eCommerce legislation (came into effect 1st July 2021) or the UK VAT on eCommerce legislation (came into effect January 2021)

The message from Amazon only mentions the EU legislation- but you are talking about having paid HMRC this VAT which is for UK only. They are 2 different things entirely.

First question is where are you based? Are you UK established? If not are you storing stock in the UK? These will all make a difference to your VAT liability.

Assuming you are UK established - then you only need to be paying HMRC VAT on your UK sales (i.e. delivered to a UK address). Pre brexit you paid VAT on all EU sales to HMRC. After brexit you only needed to be paying VAT on UK sales as the EU is now classed as an export.

The UK brought in legislation in Jan 2021 making marketplaces (like Amazon) the deemed supplier for VAT purposes. This was followed by similar EU legislation in July 2021. So any sale made after July 2021 that you sent to an EU address, then Amazon should have been collecting and remitting the VAT on your behalf.

So a £12 sale sent to UK address - you send £2 VAT to HMRC

A £12 sale to EU (after brexit Jan 2021 but pre July 2021) - you got to keep the full £12 - no VAT was due to anyone as it was technically an export (actually customer would pay VAT on delivery - but thats not the issue here)

A £12 sale to EU after July 2021 - Amazon would give you £10 and send £2 to the relevant EU tax authority. You declare income of £10 with no VAT due to HMRC

If you have been overpaying the VAT to HMRC on your EU sales after brexit then you need to explain this to HMRC. There is little Amazon can do about it.

If Amazon are saying they have not properly accounted for the VAT on your EU sales - then you may have some legal route as the legislation made Amazon the legal deemed supplier for VAT purposes. If they have not been doing it then its their fault and not yours as far as I can see. I would be surprised though if this was the case as Amazon started collecting the VAT on my EU sales straight away after July 2021.

But assuming you have been paying HMRC VAT on your EU sales and Amazon have not been collecting the VAT on these sales and you now owe Amazon this money - then the 2 will balance each other out. You will need go back through all EU sales since July 2021 and see if Amazon did indeed not remove the VAT they should have (i.e. they disbursed you £12 and not the £10 in my example above).

Now how did this all come about? It happened for me as it should straight away - but I do my own VAT returns. Were you using Amazon VAT Calculation Service by any chance? I am just curious why my EU sales were done correctly after July 2021 but yours not.