Marketplace Facilitator VAT - Some Doubts

Hello,

We have doubts about Marketplace Facilitator VAT.

Context: We are a company based in Spain that has VAT registration in UK to be able to store on Amazon UK (FBA).

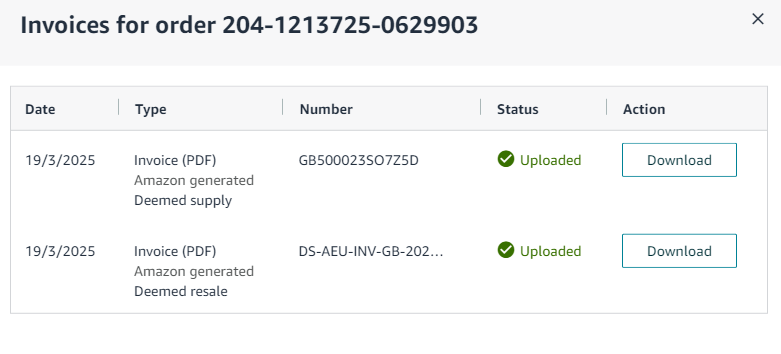

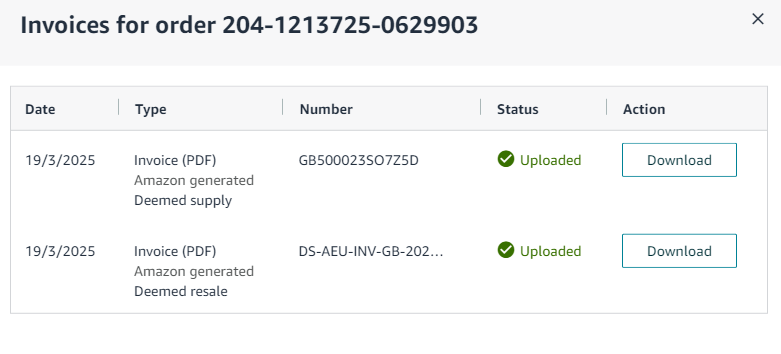

Problem: For each order we generate 2 Invoices:

1- Invoice without VAT (0%) with CIF Amazon and Marketplace Facilitator. "Deemed supply"

2-Invoice with VAT 20% (this should be correct). "Deemed resale"

Doubts:

1. Why are 2 invoices generated?

2. Is there something we are configuring wrong in Seller Central?

3. We already have AVASK who take care of the VAT declarations, can't we remove the option for Amazon to collect and declare the VAT?

Thanks in advance,

Marketplace Facilitator VAT - Some Doubts

Hello,

We have doubts about Marketplace Facilitator VAT.

Context: We are a company based in Spain that has VAT registration in UK to be able to store on Amazon UK (FBA).

Problem: For each order we generate 2 Invoices:

1- Invoice without VAT (0%) with CIF Amazon and Marketplace Facilitator. "Deemed supply"

2-Invoice with VAT 20% (this should be correct). "Deemed resale"

Doubts:

1. Why are 2 invoices generated?

2. Is there something we are configuring wrong in Seller Central?

3. We already have AVASK who take care of the VAT declarations, can't we remove the option for Amazon to collect and declare the VAT?

Thanks in advance,

0 Antworten

Ezra_Amazon

Hi @Seller_aMTc7O8A7dTC4,

Let me explain why you're seeing these 2 invoices - it's actually normal and here's why:

Due to UK and EU VAT rules, Amazon acts as a "deemed supplier" for certain marketplace sales. This means:

- The first invoice (0% VAT) represents you selling the product to Amazon as the marketplace facilitator. This is an internal transaction.

- The second invoice (20% VAT) is Amazon selling to the final customer. Amazon collects and remits this VAT to the tax authorities.

Since you're working with AVASK, they can help you ensure these transactions are properly reported in your VAT returns. They should be very familiar with this setup as it's standard for marketplace sellers.

Best regards. Ezra